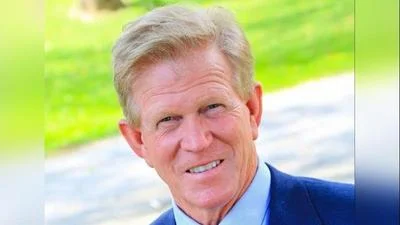

Screenshot of State Representative Brad Halbrook's May 16 Facebook post | State Representative Brad Halbrook's Facebook page

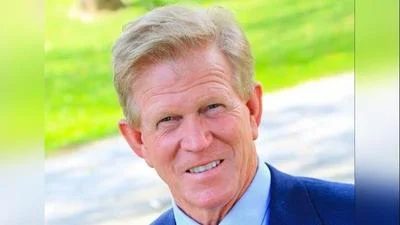

Screenshot of State Representative Brad Halbrook's May 16 Facebook post | State Representative Brad Halbrook's Facebook page

Brad Halbrook, representative for Illinois State House District 107, has expressed concerns over the expansion of the Illinois ice tax to more than 80 new categories. He argues that this move is necessary to protect residents from the state's growing tax burden.

"Illinoisans already pay the highest effective tax rates in the nation," said Halbrook, State Representative for 107th District (R), according to Facebook. "Now, Democrats want to expand the service tax to more than 80 new categories, including haircuts, car repair, landscaping, home repair and so much more. We must stop this egregious tax hike proposal and protect our residents from Illinois' ever-growing tax burdens."

According to Halbrook's Facebook post, he references a website from Americans for Prosperity that details the state's tax burdens. This includes a total state and local tax burden of 16.51%. The site also outlines more than 80 proposed service tax increases. Among these proposals is a 6.25% statewide sales tax on services such as aircraft leases and rentals longer than 60 days, armored car services, golf and country club dues, and commercial recreation fees. Other services that would be affected include barber and beauty shop services; landscaping, lawn care, tree trimming and removal; mini storage; furniture repair and cleaning; farm implement repairs; dry cleaning, pressing, dyeing, and laundering; and household appliance, TV, and radio repair.

An Illinois Policy report discusses the proposed sales tax expansion aimed at increasing government revenue and supporting Chicago’s transit systems. The report indicates that the tax on services would apply statewide rather than being limited to the Chicago area. Democrats are advocating for its passage before the General Assembly adjourns on May 31. The report estimates potential revenue generation of nearly $2 billion for the state, $50 million for counties, almost $400 million for city governments, and $315 million for Chicago’s Regional Transit Authority. It notes that Chicago residents already pay a streaming services tax and that Illinois ranks seventh in the nation for having one of the highest tax burdens.

A May 2015 report from the Center for Tax and Budget Accountability suggested that expanding Illinois’ sales taxes to include consumer services could have generated an estimated $2.105 billion.

Halbrook has been serving as a state representative since 2023. His previous terms include serving as a member of the Illinois House of Representatives from both the 102nd District (2017-2022) and the 110th District (2012-2015).

Alerts Sign-up

Alerts Sign-up