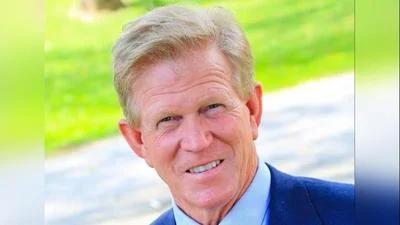

Illinois State Rep. Chris Miller (left), and Federal Housing Finance Agency Director Sandra Thompson | Sources: www.ilga.gov/house, fhfa.gov

Illinois State Rep. Chris Miller (left), and Federal Housing Finance Agency Director Sandra Thompson | Sources: www.ilga.gov/house, fhfa.gov

Illinois State Rep. Chris Miller (R-Oakland), writing on behalf of the Illinois State Freedom Caucus, called on the Federal Housing Finance Agency (FHFA) to end a new policy he says will “penalize home buyers with good credit.”

“We write to you in support of the 34 state financial officers that have called on you to rescind your agency’s policy that will penalize home buyers with good credit by making them pay more on their mortgages every month,” said the letter, signed by Miller and 11 other legislative representatives of State Freedom Caucuses around the country.

Miller's letter, sent to FHFA Director Sandra L. Thompson, is a follow-up to a letter sent to Thompson earlier this month by 34 state financial officers about the new policy.

The financial officers said the new policy “will have the net effect of making it significantly more expensive for people with good credit to buy houses.” "Incredibly, those who make down payments of 20 percent or more on their homes will pay the highest fees — one of the most backward incentives imaginable,” said the letter.

Under the new rule, buyers with a credit score of 740 or higher, taking out a $500,000 loan, would pay a fee of 0.25%, which is $1,250. After that date, the buyer could pay as much as 0.375% — or $1,875 — on that same loan,” reported ABC 7 Los Angeles. “People with lower credit scores will pay a lower rate.”

“There is no spreadsheet or formula dreamed up in a Washington, D.C., agency that would make our constituents believe that it is somehow more fair and equal to punish and tax people who are saving for a first home than those that have not made the same commitment,” said Miller's letter. “Your agency appears to be unaware that for most people outside of Washington, D.C., a house is not just a financial asset, but a dream and a solid foundation from which to build a family. Our constituents are home buyers, not house buyers. Arbitrarily making that dream harder for them to achieve and sustain is disrespectful, unfair, and financially irresponsible.”

Alerts Sign-up

Alerts Sign-up