David Harris Director the Illinois Department of Revenue | Official Website

David Harris Director the Illinois Department of Revenue | Official Website

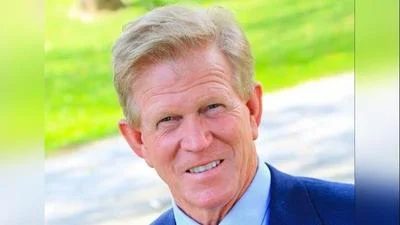

Clay County has received a tentative property assessment equalization factor of 1.0000 for 2025, according to David Harris, director of the Illinois Department of Revenue (IDOR). The equalization factor, also known as the "multiplier," is used to ensure that property assessments are uniform across all counties in Illinois. This process is necessary because many of the state's 6,600 local taxing districts span more than one county, such as school and fire protection districts.

"The property assessment equalization factor, often called the 'multiplier,' is the method used to achieve uniform property assessments among counties, as required by law. This equalization is particularly important because some of the state's 6,600 local taxing districts overlap into two or more counties (e.g., school districts, junior college districts, fire protection districts). If there was no equalization among counties, substantial inequities among taxpayers with comparable properties would result," said Harris.

State law mandates that most property in Illinois be assessed at one-third of its market value. However, farm homesites and dwellings follow standard assessing procedures while farmland and farm buildings are assessed using productivity-based standards.

The IDOR calculates the annual equalization factor for each county by comparing sales prices from the previous three years with their assessed values set by county officials. If a county's three-year average assessment level matches one-third of market value, its multiplier will be 1.0000. A higher average means a lower multiplier; a lower average results in a higher multiplier.

Assessments in Clay County were found to be at 33.33% of market value based on data from property sales in 2022, 2023, and 2024. The assigned tentative multiplier applies to taxes for 2025 payable in 2026. Last year’s equalization factor for Clay County was also set at 1.0000.

The announced figure may change if either significant changes occur due to actions by the County Board of Review or if new data prompts IDOR to revise its estimates. There will be a public hearing on this tentative multiplier within twenty to thirty days after it appears in a widely circulated county newspaper.

A change in the equalization factor does not automatically affect total property tax bills for residents. Instead, these amounts depend on how much funding local taxing bodies request annually for public services. Therefore, even if assessments rise but requested funds remain unchanged from previous years, overall tax bills will not increase.

An individual’s share of taxes depends on their property's assessed value rather than directly on any change in the multiplier itself.

Alerts Sign-up

Alerts Sign-up