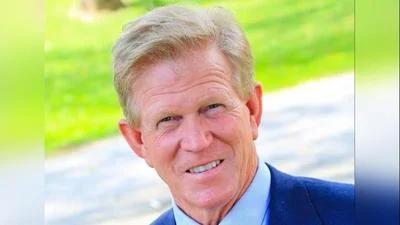

Chief Financial Officer Cory Staley | Illinois Department of Revenue

Chief Financial Officer Cory Staley | Illinois Department of Revenue

This figure marks a noticeable increase over the previous year, when County Sales Tax collection stood at $286,594.

The County Sales Tax is a local sales tax imposed on retail sales of goods and services within a specific county. It is one of the primary sources of revenue for county governments, funding a wide range of essential services, including education, infrastructure, public safety, public health, and social services. The average rate imposed in Illinois is around 8.2%.

A 2025 WalletHub study found that Illinois has the highest overall taxes in the U.S., with rates more than 50% higher than the national average. The study estimates that a median household in Illinois pays an effective tax rate of 16.58%, or about $13,099 per year.

| Year | Amount Collected | % Change from Previous Year |

|---|---|---|

| 2024 | $289,151 | 0.9% |

| 2023 | $286,594 | -3.9% |

| 2022 | $298,133 | -27.8% |

| 2021 | $412,748 | 193.7% |

| 2020 | $140,549 | -2.7% |

| 2019 | $144,442 | -64.4% |

| 2018 | $405,420 | - |

Alerts Sign-up

Alerts Sign-up