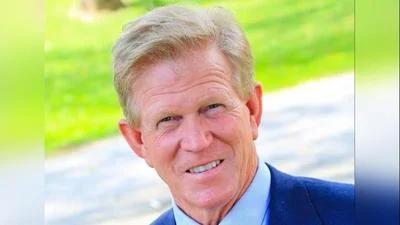

Sen. Darren Bailey | Courtesy photo

Sen. Darren Bailey | Courtesy photo

Sen. Darren Bailey (R-Louisville) voted against the $46.5 billion budget for the 2023 fiscal year.

Bailey posted video of his address prior to the vote in the Senate chamber on Facebook.

“That’ll be the fourth budget that I’ve participated in since coming here to Springfield. Here we are again: another year, another enormous budget dropped on us at the last minute. Full of promises and pork spending and who knows what else," he said. "I agree with tax cuts. I agree with supporting law enforcement. I agree with helping struggling families, but I will never agree with budgets being voted on by legislators who haven't read the bill."

Bailey said the budget had too many programs set aside for special insterests.

"Taxpayers deserve accountability here in Springfield. We must focus on fixing our fiscal mess and instituting sustainable spending reforms that prioritize middle class and working-class people over corporations and special interests," he said. "It’s time that we put an end to this nonsense of passing pork-filled budgets full of unread pages and empty promises and it’s time that we stand up for working people that you continually ask to carry the load for your woke unrealistic agendas."

"I’m voting no and I ask that anyone who values transparency and accountability join me.”

The budget was passed by the Senate and House in the early hours of April 9.

NBC5 Chicago reported that the budget includes the following elements: a suspension of the state’s 1% sales tax on groceries through July 1, 2023; the state’s fuel tax will be frozen at 39 cents per gallon through Jan. 1, 2023; the earned income tax credit will be expanded and homeowners will get up to $300 in rebates from their property taxes; also, families will get checks from the state — $50 per individual and $100 per child. Income limits of $200,000 per individual taxpayer, or $400,000 for joint followers, will be attached to the checks, officials said.

Alerts Sign-up

Alerts Sign-up