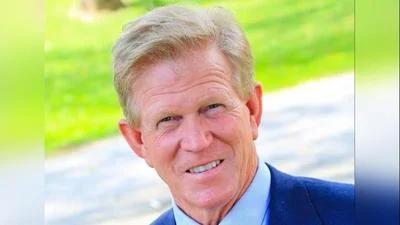

State Sen. Dale Righter (R-Mattoon) cast the decisive vote for a state income tax hike that will cost taxpayers in his district another $55 million this year. | Illinois State Senate

State Sen. Dale Righter (R-Mattoon) cast the decisive vote for a state income tax hike that will cost taxpayers in his district another $55 million this year. | Illinois State Senate

State Senator Dale Righter (R-Mattoon) told reporters earlier this week that voters in his East Central Illinois district wanted him to vote to raise their state income taxes.

Well, it is now official: a 32 percent state tax hike is now law.

And Righter's constituents will be paying an additional $55.2 million in state income tax this year, according to an analysis by Local Government Information Services (LGIS), which publishes the East Central Reporter.

LGIS used Illinois Department of Revenue data combined with a forecast by Senate Democrats to estimate how much additional tax will be paid by Illinois zip code.

The communities in eastern central Illinois that would pay the most: Effingham ($6.11 million total/$639 per person), Mattoon ($5.19 million/$543), Charleston ($4.13 million/$524) and Robinson ($2.74 million/$585).

Righter's district includes all or part of 12 counties: Clark, Clay, Crawford, Cumberland, Edwards, Effingham, Jasper, Lawrence, Richland, Wabash, Wayne and White.

Retroactive to July 1, the higher rate-- now 4.95 percent, up from 3.75 percent-- increased income tax will be withheld from employee paychecks over the last six months of 2017.

An employee earning $50,000 once paid $72 in state income tax per paycheck. Starting immediately, they will pay $95, or an additional $600 per year.

Senate Democrats estimate the tax hike will siphon $4.453 billion more this year from individual taxpayers. Businesses will pay another $1 billion.

Chicago Democrats gave Righter a $4.8 million "earmark" to build an air conditioning system in an Eastern Illinois University lecture hall as consideration for voting for the tax hike.

Editor's Note: An earlier version of this story incorrectly reported that the income tax hike was retroactive to Jan. 1, not July 1.

---

How much more will your community pay?

The state income tax rate has increased to 4.95 percent from 3.75 percent, how much more will taxpayers in your community pay for state government?

| Ranking | Community | Zip | Estimated State Income Tax Increase |

| 1 | Effingham | 62401 | $6,114,721.61 |

| 2 | Mattoon | 61938 | $5,192,623.39 |

| 3 | Charleston | 61920 | $4,134,812.49 |

| 4 | Robinson | 62454 | $2,742,576.21 |

| 5 | Mount Carmel | 62863 | $2,633,605.16 |

| 6 | Olney | 62450 | $2,595,247.97 |

| 7 | Fairfield | 62837 | $1,908,113.79 |

| 8 | Carmi | 62821 | $1,868,359.87 |

| 9 | Marshall | 62441 | $1,764,509.17 |

| 10 | Lawrenceville | 62439 | $1,687,741.37 |

| 11 | Teutopolis | 62467 | $1,519,535.74 |

| 12 | Newton | 62448 | $1,466,823.74 |

| 13 | Flora | 62839 | $1,284,608.28 |

| 14 | Altamont | 62411 | $1,034,485.29 |

| 15 | Casey | 62420 | $1,006,879.01 |

| 16 | Albion | 62806 | $788,845.34 |

| 17 | Oblong | 62449 | $738,592.34 |

| 18 | Neoga | 62447 | $707,845.54 |

| 19 | Norris City | 62869 | $695,710.55 |

| 20 | Greenup | 62428 | $627,349.65 |

| 21 | Dieterich | 62424 | $613,506.12 |

| 22 | Louisville | 62858 | $596,076.58 |

| 23 | Bridgeport | 62417 | $574,418.99 |

| 24 | Toledo | 62468 | $543,875.07 |

| 25 | Martinsville | 62442 | $507,613.75 |

| 26 | Sumner | 62466 | $484,037.11 |

| 27 | Palestine | 62451 | $448,785.44 |

| 28 | Grayville | 62844 | $430,754.38 |

| 29 | Noble | 62868 | $428,068.56 |

| 30 | Wayne City | 62895 | $427,303.36 |

| 31 | Flat Rock | 62427 | $379,028.35 |

| 32 | Watson | 62473 | $379,014.14 |

| 33 | Beecher City | 62414 | $363,648.11 |

| 34 | Humboldt | 61931 | $358,378.04 |

| 35 | West Salem | 62476 | $355,795.37 |

| 36 | Xenia | 62899 | $351,158.41 |

| 37 | Mason | 62443 | $349,734.85 |

| 38 | Lerna | 62440 | $341,724.49 |

| 39 | Oakland | 61943 | $341,203.75 |

| 40 | Clay City | 62824 | $333,134.97 |

| 41 | Cisne | 62823 | $317,568.96 |

| 42 | Ashmore | 61912 | $301,705.34 |

| 43 | Crossville | 62827 | $282,597.53 |

| 44 | Enfield | 62835 | $255,559.62 |

| 45 | Saint Francisville | 62460 | $251,218.15 |

| 46 | Montrose | 62445 | $240,848.79 |

| 47 | Hutsonville | 62433 | $239,091.57 |

| 48 | Allendale | 62410 | $227,287.34 |

| 49 | Shumway | 62461 | $225,873.25 |

| 50 | Wheeler | 62479 | $212,522.83 |

| 51 | Dennison | 62423 | $195,550.89 |

| 52 | West Union | 62477 | $190,569.48 |

| 53 | Geff | 62842 | $188,527.55 |

| 54 | Claremont | 62421 | $182,383.87 |

| 55 | Edgewood | 62426 | $172,774.18 |

| 56 | Westfield | 62474 | $159,324.83 |

| 57 | Jewett | 62436 | $151,903.37 |

| 58 | Dundas | 62425 | $136,988.88 |

| 59 | Willow Hill | 62480 | $126,087.46 |

| 60 | Hidalgo | 62432 | $122,868.52 |

| 61 | Trilla | 62469 | $117,063.77 |

| 62 | Annapolis | 62413 | $109,604.68 |

| 63 | Mount Erie | 62446 | $107,806.68 |

| 64 | West Liberty | 62475 | $102,415.30 |

| 65 | Mill Shoals | 62862 | $102,366.36 |

| 66 | Ellery | 62833 | $97,909.12 |

| 67 | Yale | 62481 | $97,368.64 |

| 68 | Browns | 62818 | $92,555.11 |

| 69 | Parkersburg | 62452 | $88,915.69 |

| 70 | West York | 62478 | $88,703.86 |

| 71 | Ingraham | 62434 | $87,862.88 |

| 72 | Springerton | 62887 | $84,188.99 |

| 73 | Barnhill | 62809 | $83,147.24 |

| 74 | Keenes | 62851 | $80,498.00 |

| 75 | Calhoun | 62419 | $75,543.17 |

| 76 | Sims | 62886 | $68,227.22 |

| 77 | Rinard | 62878 | $67,528.34 |

| 78 | Bone Gap | 62815 | $66,148.98 |

| 79 | Johnsonville | 62850 | $63,943.65 |

| 80 | Sainte Marie | 62459 | $52,095.47 |

| 81 | Burnt Prairie | 62820 | $47,600.07 |

| 82 | Bellmont | 62811 | $46,927.23 |

| 83 | Keensburg | 62852 | $30,076.86 |

| 84 | Golden Gate | 62843 | $19,131.23 |

| 85 | Stoy | 62464 | $18,262.89 |

| 86 | Maunie | 62861 | $12,019.74 |

| TOTAL | $55,209,409.93 |

Note: Assumes tax increase will meet Senate Democrats' projections.

Top income tax-paying communities in east central Illinois

Which communities pay the highest income taxes in east central Illinois?

| Ranking | Communities | Zip | Average State Income Tax Increase | Total Returns filed by Zip |

| 1 | Teutopolis | 62467 | $791 | 1,922 |

| 2 | Humboldt | 61931 | $695 | 516 |

| 3 | Burnt Prairie | 62820 | $690 | 69 |

| 4 | Barnhill | 62809 | $665 | 125 |

| 5 | Dennison | 62423 | $656 | 298 |

| 6 | West Liberty | 62475 | $640 | 160 |

| 7 | Effingham | 62401 | $639 | 9,571 |

| 8 | Springerton | 62887 | $638 | 132 |

| 9 | Lerna | 62440 | $629 | 543 |

| 10 | Mill Shoals | 62862 | $628 | 163 |

| 11 | Ellery | 62833 | $616 | 159 |

| 12 | Norris City | 62869 | $615 | 1,132 |

| 13 | Mount Carmel | 62863 | $613 | 4,297 |

| 14 | Browns | 62818 | $597 | 155 |

| 15 | Mount Erie | 62446 | $596 | 181 |

| 16 | Dieterich | 62424 | $589 | 1,041 |

| 17 | Crossville | 62827 | $589 | 480 |

| 18 | Trilla | 62469 | $585 | 200 |

| 19 | Robinson | 62454 | $585 | 4,687 |

| 20 | Carmi | 62821 | $584 | 3,199 |

| 21 | Annapolis | 62413 | $583 | 188 |

| 22 | Hutsonville | 62433 | $582 | 411 |

| 23 | Watson | 62473 | $579 | 655 |

| 24 | Montrose | 62445 | $564 | 427 |

| 25 | Yale | 62481 | $563 | 173 |

| 26 | Enfield | 62835 | $552 | 463 |

| 27 | Geff | 62842 | $550 | 343 |

| 28 | Shumway | 62461 | $548 | 412 |

| 29 | Newton | 62448 | $546 | 2,688 |

| 30 | Mattoon | 61938 | $543 | 9,565 |

| 31 | Marshall | 62441 | $542 | 3,258 |

| 32 | Claremont | 62421 | $540 | 338 |

| 33 | Albion | 62806 | $538 | 1,467 |

| 34 | West York | 62478 | $538 | 165 |

| 35 | Jewett | 62436 | $535 | 284 |

| 36 | Saint Francisville | 62460 | $533 | 471 |

| 37 | Allendale | 62410 | $532 | 427 |

| 38 | Oblong | 62449 | $525 | 1,406 |

| 39 | Ashmore | 61912 | $525 | 575 |

| 40 | Charleston | 61920 | $524 | 7,893 |

| 41 | Flat Rock | 62427 | $521 | 727 |

| 42 | Lawrenceville | 62439 | $521 | 3,238 |

| 43 | Wheeler | 62479 | $521 | 408 |

| 44 | Casey | 62420 | $510 | 1,976 |

| 45 | Noble | 62868 | $508 | 843 |

| 46 | Keenes | 62851 | $506 | 159 |

| 47 | Ingraham | 62434 | $505 | 174 |

| 48 | Wayne City | 62895 | $503 | 849 |

| 49 | Altamont | 62411 | $500 | 2,070 |

| 50 | Dundas | 62425 | $498 | 275 |

| 51 | Neoga | 62447 | $497 | 1,425 |

| 52 | Toledo | 62468 | $497 | 1,095 |

| 53 | Grayville | 62844 | $493 | 873 |

| 54 | Fairfield | 62837 | $493 | 3,870 |

| 55 | Palestine | 62451 | $490 | 915 |

| 56 | Oakland | 61943 | $489 | 698 |

| 57 | West Union | 62477 | $487 | 391 |

| 58 | Hidalgo | 62432 | $486 | 253 |

| 59 | Xenia | 62899 | $484 | 726 |

| 60 | West Salem | 62476 | $481 | 740 |

| 61 | Olney | 62450 | $477 | 5,438 |

| 62 | Sumner | 62466 | $477 | 1,015 |

| 63 | Martinsville | 62442 | $476 | 1,066 |

| 64 | Parkersburg | 62452 | $475 | 187 |

| 65 | Louisville | 62858 | $467 | 1,277 |

| 66 | Mason | 62443 | $466 | 750 |

| 67 | Bridgeport | 62417 | $465 | 1,234 |

| 68 | Westfield | 62474 | $465 | 343 |

| 69 | Sainte Marie | 62459 | $457 | 114 |

| 70 | Golden Gate | 62843 | $456 | 42 |

| 71 | Greenup | 62428 | $453 | 1,384 |

| 72 | Rinard | 62878 | $444 | 152 |

| 73 | Bone Gap | 62815 | $444 | 149 |

| 74 | Flora | 62839 | $441 | 2,913 |

| 75 | Sims | 62886 | $440 | 155 |

| 76 | Calhoun | 62419 | $437 | 173 |

| 77 | Clay City | 62824 | $431 | 773 |

| 78 | Johnsonville | 62850 | $429 | 149 |

| 79 | Cisne | 62823 | $427 | 743 |

| 80 | Beecher City | 62414 | $427 | 852 |

| 81 | Willow Hill | 62480 | $420 | 300 |

| 82 | Keensburg | 62852 | $406 | 74 |

| 83 | Edgewood | 62426 | $401 | 431 |

| 84 | Maunie | 62861 | $401 | 30 |

| 85 | Stoy | 62464 | $380 | 48 |

| 86 | Bellmont | 62811 | $361 | 130 |

Alerts Sign-up

Alerts Sign-up