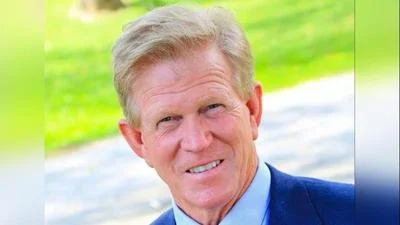

Reports indicate that Republican Sen. Dale Righter of Mattoon will vote in favor of a new budget bill dubbed the “grand bargain.”

The set of bills, which follows over a year of tumultuous budget talks in the longest-running state budget problem in the nation which has resulted in a virtual shutdown of state budget business, includes a lot of changes for taxpayers. Already Illinois taxpayers have a significantly higher tax burden than most people throughout the nation, but if this latest legislation passes, the burden will increase significantly.

The “grand bargain" includes several key factors. Among them is an income tax hike that could leave Illinois residents paying roughly two weeks of their annual salary in new taxes. The legislation that calls for the personal income tax rate to be raised to 3.95 percent also increases corporate taxes to 7 percent. That amounts to a 33 percent income tax hike, said the Illinois Policy Institute, which analyzes legislation and public policy matters.

Additionally, a proposed tax on sugary beverages of a penny per ounce would result in residents providing approximately $200 million to 300 million annually to support the state’s budget, while in the meantime the government borrows $7 billion to pay off existing debts.

Other matters covered by the budget include a Chicago Casino Development Authority, an increase in the state minimum wage to $11 per hour and a freeze on property tax hikes for the next two years. Finally, the proposed budget, if adopted, will provide $215 million to the Chicago Teachers Pension in 2016 and an additional $225 million to the fund in 2017.

Alerts Sign-up

Alerts Sign-up