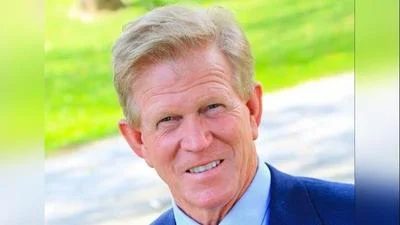

Director David Harris | Illinois Department of Revenue

Director David Harris | Illinois Department of Revenue

This figure marks a noticeable increase from the previous month, where County Sales Tax collection stood at $81,048.

Over the past 12 months, Douglas County's residents have collectively paid a total of $1.1 million in County Sales Tax.

The County Sales Tax is a local sales tax imposed on retail sales of goods and services within a specific county. It is one of the primary sources of revenue for county governments, funding a wide range of essential services, including education, infrastructure, public safety, public health, and social services. The average rate imposed in Illinois is around 8.2%.

Despite fluctuations in tax collection, Illinois continues to be one of the highest-taxed states in the U.S. According to a Wallet Hub study from March 2023, the state ranked as having the highest tax burden, approximately 39.83% above the national average.

Illinois governor J. B. Pritzker is accused of adding more than $5.2 billion in new or higher taxes since coming into power in early 2019. As a business owner, he has a fortune of more than $3 billion, largely based on his family's wealth and connections.

| Month | Amount Collected | % Change from Previous Month |

|---|---|---|

| September | $83,376 | 2.9 |

| August | $81,048 | -5.7 |

| July | $85,985 | -12.6 |

| June | $98,432 | 20.6 |

| May | $81,643 | -11.8 |

| April | $92,553 | 12.5 |

| March | $82,246 | -18.5 |

| February | $100,950 | 2.5 |

| January | $98,478 | 2.3 |

| December 2023 | $96,245 | -0.9 |

| November 2023 | $97,136 | -9.2 |

| October 2023 | $106,949 | 20.1 |

Alerts Sign-up

Alerts Sign-up